What happens if you divorce a disabled spouse?

The short answer: divorce becomes more complicated than usual. Disability can affect benefits, alimony, custody, and property division in ways that most couples don’t expect. Programs like SSI, Medicaid, and veterans’ benefits may change after divorce, while courts often consider higher support for the disabled partner. In short, every decision carries long-term consequences.

In this blog, I’ll break down everything you need to know about divorcing a spouse with a disability, from how benefits like SSDI, SSI, and Medicaid are impacted to what judges look at in custody, alimony, and property division. I’ll also cover healthcare coverage, settlement terms, real-life scenarios, and a step-by-step divorce timeline so you can prepare with clarity and confidence.

Many divorces stem from emotional abuse. If you want a faith-based view, explore our article on emotionally abusive husbands in the Bible.

Divorce: What It Really Means

Divorce can be explained as a process of the end of a marriage by a court, which enables two spouses to be legally single once again. Divorce not only involves the signing of documents, but a formal process defines how property and money, along with unpaid debts and parental roles, are divided. The divorcing process can involve negotiation, submission, and defense of legal papers, hearings, and, in most cases, settlements over how much support should be paid and the child custody issues.

There are even rules per state, which determine the mode in which divorce functions in each state in the U.S, hence, depending on where you live, it can be quite different.

Read Also: How to Deal With Infidelity Guilt

Type of Disability and Benefits Involved

Types of Disabilities in Divorce

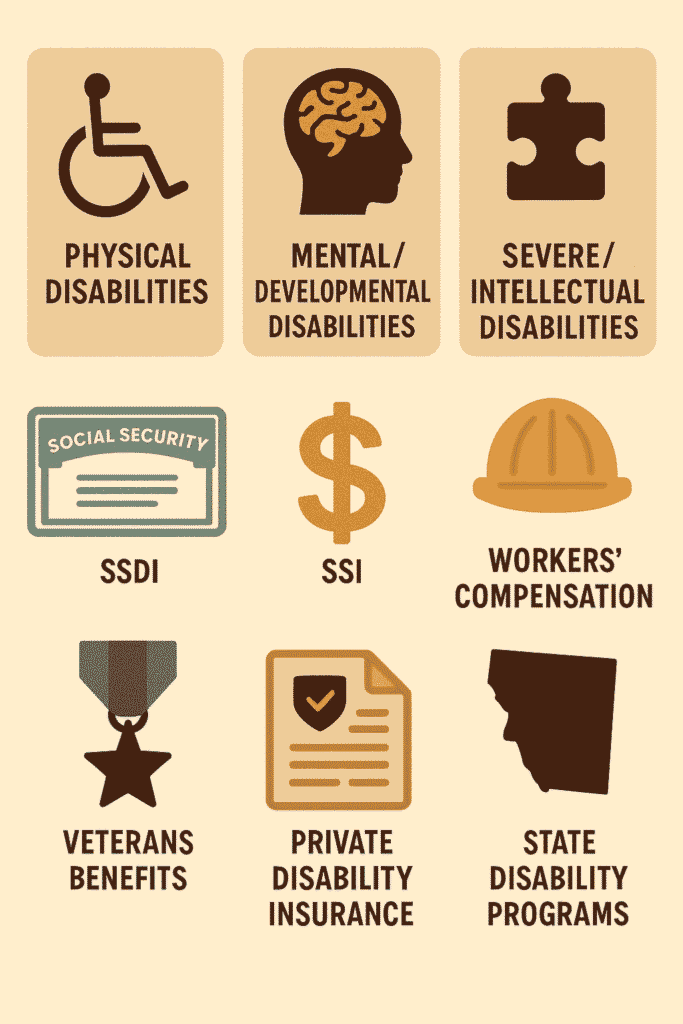

Benefit plans and courts usually categorize disability into three groups, as per my observations:

- Physical disabilities: walking difficulty because of chronic illness, paralysis, loss of muscle force, and problems with mobility.

- Mental/developmental issues encompass schizophrenia, PTSD, and chronic depression, among other mental illnesses, which have a huge impact on everyday tasks.

- Devastating disorders or mental disability: case of autism or intellectual disability, brain impairment, or any other kind of learning, rational, or communication disorder.

Disability Benefits at Risk

Some common examples are:

- SSDI (Social Security Disability Insurance): To a person who has previously worked and contributed to Social Security.

- Supplemental Security Income (SSI) is a needs-based program only available to those with the lowest incomes and assets.

- Veterans Benefits: In cases of service-related disabilities, veterans may be eligible for supplementary allowances to support their dependents.

- Workers’ Compensation: In case the disability has been brought about by a workplace injury.

- Private Long-Term Disability Insurance: Possess a personal or through an employer policy.

- State Disability Programs: Individuals in some states receive other amounts besides federal benefits.

Ending any unhealthy or toxic bond requires emotional recovery, and these final goodbye quotes can help.

3. Why This Step is So Important

By plotting ahead of time, the nature of disability and support you will get the whole picture so that you can:

- Shield the perks that your wife cannot do without.

- Do not provide settlement terms that inadvertently overlook them.

- Plan realistic alimony or property division terms that account for care costs.

Check Also: Do You Know Your Relationship Red Flags?

Calculating Care Costs

1. Learn What Disability Related Needs Entail

Needs in disability may comprise:

- Treatment includes doctor visits, counseling, checkups, specialists, and treatments.

- Mobile devices include things like wheelchairs, walkers or canes, scooters, and prosthetic limbs.

- Other home modifications are available, such as ramps, a stair lift, a bigger door, and wheelchair accessible restroom.

- Examples of in-home care include nurse care, hospice care, and personal care attendants.

- Transport: altered cars, transport services, or special traveller passes.

- Assistive technology: devices with speech, hearing aids, reading machines for the screen, and different accessibility devices.

2. Compute Costs Present and Future

Breaking it down is how you can do it in this way:

- Present-day monthly costs: treatment, medical appointment, wages of the assistant, and utilities associated with medical suggestions (e.g., oxygen equipment).

- Annual expenses: replacement of equipment, one-time repairs, and annual checkups by specialists.

- Future costs: expected shifts in medical recommendations, age-related changes in care needs, or worsening of illness.

It is impossible to just guess these numbers. Use:

- Medical provider estimates

- Past billing history

- Quotes from suppliers and contractors

3. Why Documentation Is Critical in Divorce Cases

Solid evidence can include:

- Receipts for equipment and medications

- Invoices for home modifications and services

- Medical reports detailing why certain expenses are essential

- Insurance statements showing out-of-pocket amounts

Divorce Impact on Benefits

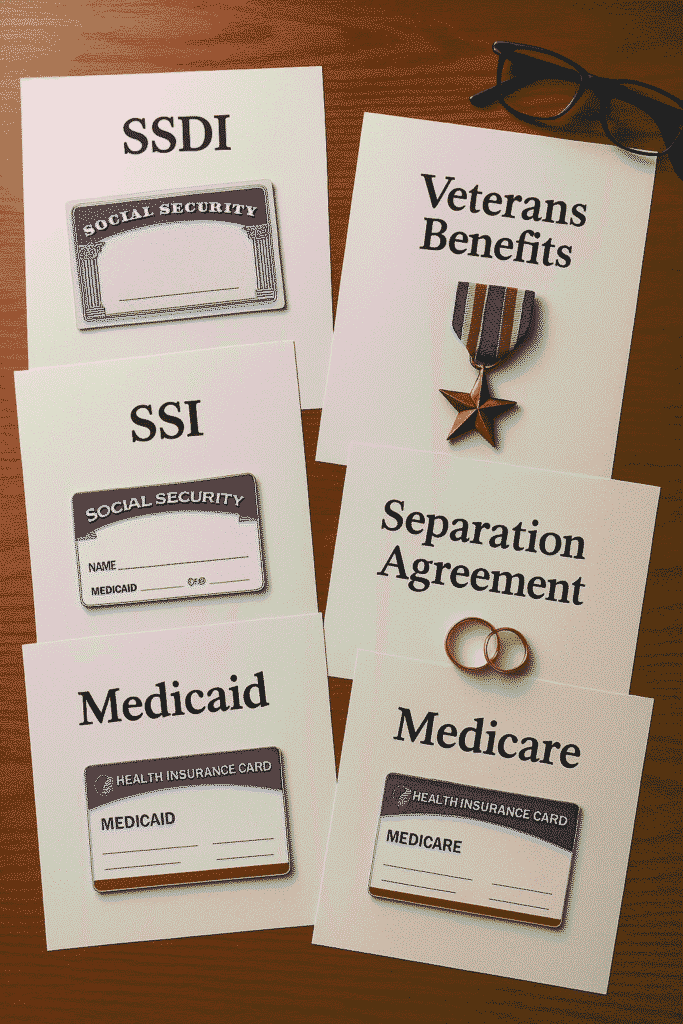

SSDI and SSI

- SSDI: Based on work history, divorce usually won’t stop payments, but dependent benefits can change.

- SSI: Needs-based: your income after divorce may affect your spouse’s eligibility.

Veterans Benefits

- Some are protected, others can be split or transferred depending on service records.

Medicaid and Medicare

- Divorce may shift coverage eligibility: Medicaid is income-based; Medicare usually continues.

Alimony and Disability

How Disability Changes the Equation

- I’ve noticed judges are more likely to order long-term or higher alimony when the spouse has a serious disability.

- Key factors courts weigh:

- Severity of disability

- Ability to work or retrain

- Cost of care

Types of Support

- Temporary alimony during the divorce

- Rehabilitative support (to retrain or recover)

- Permanent support in severe cases

Check Also: How Well Do You Know Your Partner?

Custody and Disabled Parents

You need to know exactly what factors are looked at, so you can prepare for them.

How Courts Make Decisions

- Best Interests of the Child: The judges assume the safety, stability, emotional well-being, and the capacity of each parent to address the needs of a child.

- Effect of Disability: The court will determine the impact that disability has on everyday parenting activities. The fact that someone is disabled does not count, but the effect does.

- Support Systems: Physical support is important, so in case a parent with disability has a well-knit family, a quality childcare provider, or an assistive device that support can demonstrate to the court that he or she is able to create a safe, loving home.

Read Also: Free Dating For Disabled People

Custody Arrangements

- Joint Custody: Can be done when parents cooperate and the disabled parent can accommodate the core in aiding it.

- Sole Custody with Visitation: In cases where the disabled parent cannot take day-to-day care, he/she can have a substantial visitation.

- Supervised Visitation: To be applied in cases where the court believes that they need to monitor, it might be a temporary process until the issues are handled.

Parenting Plans adapted to Disability.

- Make flexible schedules to allow time to have medical check-ups or therapy sessions.

- Parking spaces ought to be set up in case someone has trouble moving about.

- Take measures aimed at ensuring that the child feels comfortable and safe.

Breakup Probability Calculator

Love Compatibility Calculator | Future Wedding Date Predictor | Jealousy & Trust Score Test | First Kiss Date Finder | Who Says “I Love You” First? | Long-Distance Survival Score | How Toxic Are You? Test | Red Flag Detector | Who Loves More? Love Test | Should I Block My Ex? Test | Ex Comeback Calculator | Situationship Meter | Who’s More Annoying? Test

Property Division and Disability

Fairness, not only equality, is considered in courts, and disability may swing the pendulum in the disposal of property.

How the Law Handles It

- In the U.S., states either use community property principles (marital property is divided 50-50) or equitable distribution principles (marital property is divided fairly according to the situation).

- The court can grant your spouse a higher portion of marital property in case the disability has impaired his/her income or the capacity to meet medical expenses.

Marital vs. Separate Property: What Counts as

- Home ownership, automobiles, money, retirement plans, investments, assets, and debts accrued during a marriage are all considered marital property.

- Separate property: Unless the property has been mixed with marital funds, assets acquired before marriage, inheritances, and gifts are normally maintained by the original owner.

Disability-Related Considerations

- Medical equipment: Hospital beds, wheelchairs, and other specialized equipment are typically considered the disabled spouse’s personal belongings.

- Home adaptations: Ramp, enlarged doorways, or adapted bathrooms can be of increased value to a property, and the court can give the spouse requiring the adaptations the home.

- Retirement accounts: Part of the disability benefits may influence the retirement savings distributions, and their division should be planned properly to evade taxes or benefit complications.

Health Insurance After Divorce

I always recommend you focus on this part early in the divorce process.

1. Review Current Coverage

- Just examine your existing health insurance policy: Who is covered, what is covered, and how much is paid per month.

- Check the coverage status of both spouses at an employer-sponsored plan and what happens to the coverage once the divorce is finalized.

2. COBRA Continuation

- In case you are covered by the spouse’s employer, then you are eligible under COBRA (Consolidated Omnibus Budget Reconciliation Act) continuation.

- COBRA allows you to retain the same policy but temporarily (typically 18-36 months), and at the full premium charged and an administration fee.

3. Medicaid and Medicare Options

- Medicare usually continues if you already qualify by age or disability.

- Medicaid eligibility may change based on your income after divorce, important if you or your spouse relies on it for long-term care.

4. Private Insurance Plans

- Shop around on the Health Insurance Marketplace when COBRA is not affordable or you do not qualify.

- Make a note of specialist cover, prescriptions, and continuing treatment concerning the disability.

5. Prescription Coverage

- Avoid a lapse in medication coverage.

- Should you have to change provider or plan, ask that an overlap period be created so you do not miss a dose.

6. Dental, Vision, and Specialty

- Remember about dental, vision, and hearing, which might be covered under your plan or need to be separately insured.

- Confirm the availability of special equipment involved in case of disabilities that need special equipment (e.g., mobility aids, hearing aids).

7. Health Care Settlement Negotiations

Include clauses to address future premium increases or changes in medical needs.

You can negotiate for the non-disabled spouse to contribute to health insurance costs in the settlement.

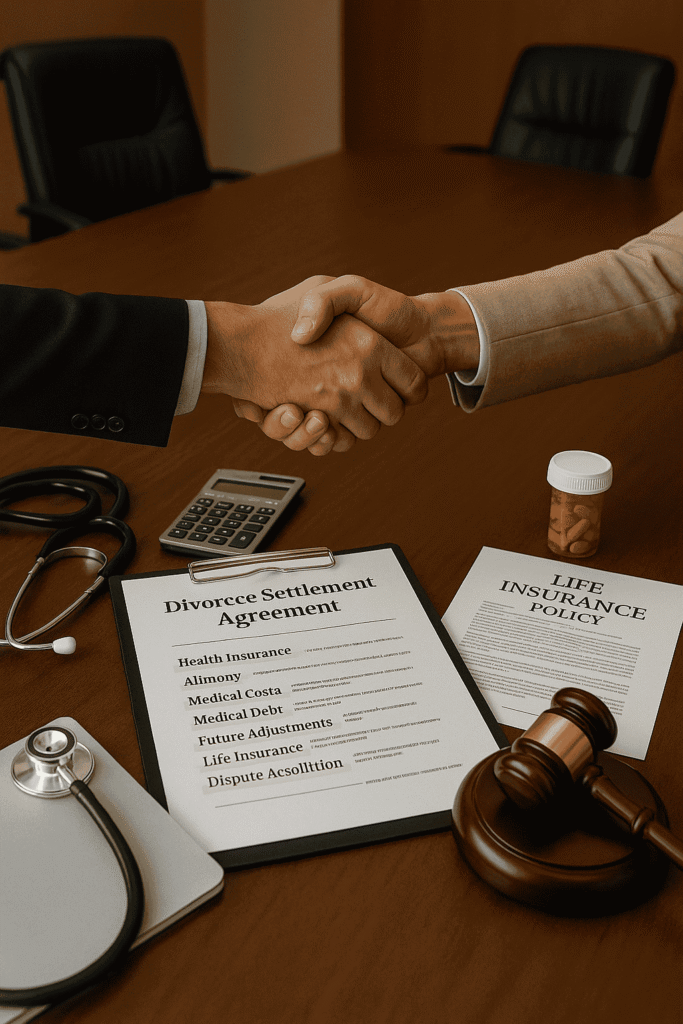

Key Settlement Terms

Here are the terms you should seriously consider including:

1. Health Insurance Coverage

- Spell out exactly who is responsible for paying health insurance premiums.

- If your spouse relies on a private plan through your employer, negotiate for COBRA coverage or equivalent until they secure other insurance.

- Include a clause for prescription drug coverage and ongoing treatments.

2. Alimony Tied to Disability Needs

- Note the length of time, the frequency of alimony payments, and the amount due.

- Severe disabilities may require you to make it permanent or long-term over short-term.

- Look at cost-of-living considerations or increases in the event of an increased health cost.

3. Medical and Caregiving Costs

- Plan the sharing of medical costs between now and in the future.

- Add the home-care, physical therapy, or special care plan.

- Consider the prices of equipment replacement (wheelchairs, prosthetics, hearing aids).

4. Division of Medical Debt

- If you have outstanding medical bills from the marriage, specify how they will be split.

- Avoid vague language, list exact accounts or creditors.

5. Future Cost Adjustments

- Medical needs can change overnight, so I always recommend including a review clause.

- This allows you to revisit and adjust alimony or support if there’s a significant change in disability status or medical expenses.

6. Life Insurance as Security

- If alimony or medical expenses will be ongoing, require a life insurance policy naming the disabled spouse as beneficiary.

- This ensures financial support continues even if the paying spouse passes away.

7. Clear Dispute Resolution Method

- Rather than having to go to court whenever a dispute arises, insert a mediation or arbitration clause that will settle disputes expeditiously.

Common Divorce Scenarios

Knowing them can be a good preparatory measure to handle them emotionally, financially, and legally as well.

- Disability was Pre- Marriage

- Here, both partners were aware of the disability when they got into the marriage.

- It is frequently assumed, in the courts, that you anticipated this in a relationship, and yet they do include long-term care needs in alimony and property partition.

- Disability Developed During the Marriage

- Such a situation is usually the toughest emotionally and financially.

- The roles, income, and plans are alterable by a sudden illness, accident, or mental health condition.

- The long-term support is also more likely to be sympathetic in such cases, particularly where there is impairment of the ability to earn.

- One Husband Quit His Job to Work as a Full-Time Caregiver

- I have witnessed cases of a partner abandoning their career in order to attend to their spouse.

- This may impact the savings in retirement and work experience, as well as the re-entry of the caregiver into the labour market.

- It is a sacrifice that is taken into account in the division of assets or in giving alimony in courts.

- Divorce as Separation is an Option

- Certain couples opt out of divorce and rely on legal separation so that they do not lose health insurance or disability benefits.

- This is possible where both parties accept to be legally married but to live separate lives with a written separation agreement.

- Both Spouses Have Disabilities

- This is not as typical but adds another level of complexity.

- Advantages should be at par with disadvantages, supporting requirements, and care plans.

- High-Conflict Divorce Over Benefits

- Sometimes the major conflicts are not over love being lost, they are over whose side will have how the benefits remain open, and who covers the bill.

- It is critical to have the documentation and the legal direction in such cases.

Read Also: Is Marriage Counseling Covered By TRICARE?

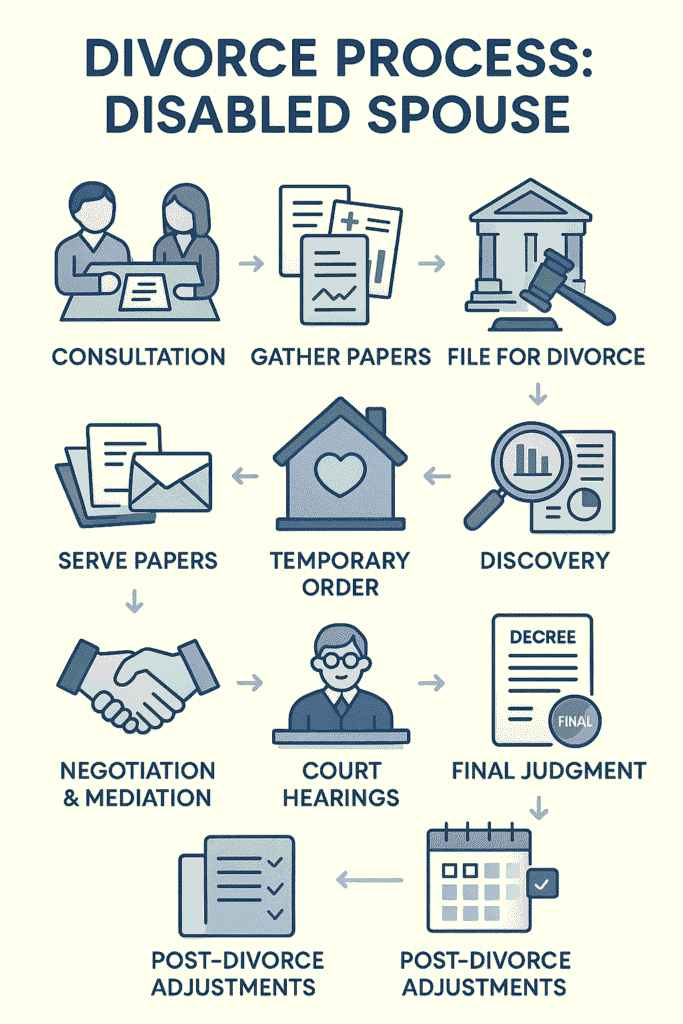

Divorce Timeline Step by Step

- Consultation with the Divorce Lawyer

- And this is your initial formal formality.

- Talk to an attorney who knows family law and disability benefits.

- Bring simple facts about your marriage, your disabled spouse, and the benefits involved.

- Gather All the Relevant Papers

- Medical statistics and disability savings certificates.

- Income, assets, debts: financial documents.

- Evidence of disability: expenses.

- Property and insurance details.

- File for Divorce

- Your lawyer files the petition in your state’s court.

- The petition includes your proposed terms for property division, custody (if applicable), and support.

- Serve the Divorce Papers

- Serve your spouse a notification of divorce.

- This is done in certain states by a process server or sheriff.

- Temporary Order (Where Required)

- Ask for temporary support as a spouse, custody, or continuing exclusive use of the house pending the proceedings.

- Particularly relevant when the injured party is the disabled spouse who depends greatly on constant care and provision.

- Discovery Phase

- Both parties share specific financial, medical, and legal data.

- It is here that your records of costs, benefits, and needs will come in handy.

- Negotiations and Mediation

- Try to reach an out-of-court settlement to save money, time, and worry.

- Mediation can also be useful in establishing equitable conditions of support, health care, and benefit protection.

- Court Hearings (No agreement)

- Unresolved issues will be resolved by a judge after listening to evidence.

- Such factors as disability can have serious implications for judgments on alimony, property, and custody.

- Final Judgment

- A divorce becomes official after the court issues a decree on behalf of divorce.

- Such a ruling entails all final property, custody, and support arrangements.

- Post-Divorce Adjustments

- Advise agencies of benefits, insurers, and banks.

- Review and adjust support payments as disability needs or costs change.

- Keep a record of ongoing expenses for possible future modifications.

The court is interested in the legal result, but the emotional component of divorce can be the consequence of the conflict that has not been resolved. This Unhealthy Conflict in Relationships Guide steps you through how to manage fights that have gotten out of hand. can serve you with the deeper patterns.

Documents You Must Gather

Here’s what I recommend you collect:

- Medical Records and Reports

- Full medical diagnoses

- Treatment history and progress notes

- Doctor’s statements about current and future care needs

- Any disability determination letters from Social Security or other agencies

- Benefit Statements

- SSDI or SSI payment details, including award letters and recent statements

- Veterans’ benefits letters and breakdowns

- Workers’ compensation claims and payment records

- Private disability insurance policy and payout details

- Health Insurance Papers

- The existing health insurance policy (and additional plans)

- Premium amounts and coverage limits

- Prescription coverage details

- Statements of recent claims or medical expenses covered

- Financial Records

- Bank statements for the past 12–24 months

- Tax returns for the last 2–3 years

- Pay stubs or income verification for both spouses

- Credit card statements showing care-related expenses

- Expense Documentation

- Receipts of mobility equipment, home modifications, therapy sessions, and in-home care

- Medical transportation costs

- Utility and housing costs, if tied to accessibility

- Property and Asset Records

- Deeds and mortgage statements for the marital home

- Vehicle titles and loan statements

- Retirement accounts, investments, and savings accounts

- Lists of personal property, including medical or adaptive equipment

- Debt Records

- Medical debt statements

- Personal loans

- Credit card balances (particularly due to care)

- Legal and Custody Documents (in case)

- Any prior custody decree or parenting plans

- Power of attorney/Guardianship forms

- Any prior legal agreements regarding support or property

Read Also: 7 Qualities Of A Healthy Relationship

FAQs:

Can I divorce my disabled spouse?

Yes, disability does not prevent divorce, but extra legal and financial factors may apply.

Will I have to pay more alimony?

Possibly. Courts may consider your spouse’s disability when deciding spousal support.

Who gets custody if a parent is disabled?

The court looks at the child’s best interests, not just the disability itself.

Does disability affect property division?

Not directly, but medical needs and income limits can influence decisions.

Final Words:

Separating from a handicapped partner cannot be an ordinary legal representation; it is emotional, economic, and mostly transformational. Whether it is comprehending the benefits, preparing for further care, or all the decisions you make today will influence the future of both of you. Here is my tip: plan, take all documents possible to you, and seek the help of those who know the challenges disability presents to divorce.

When you do it compassionately and with a clear understanding of your rights, you will be in the best position to work in your interests and yet satisfy the necessary needs of your spouse. It is not a mere aim to break up a marriage; it is to transition with dignity, stability, and a conscious plan for your next phase.

Pingback: What Does The Bible Say About Dating? - reallovetips.com

Pingback: How to Deal With Infidelity Guilt - reallovetips.com